The total value of this transaction is DKK 9 billion, equivalent to nearly 9 billion RMB (US $1.4 billion), including 50% equity value and financing of half of the EPC lump sum. Ørsted is responsible for the construction, 20-year operation and maintenance of the whole wind farm, and green power trading generated by the wind farm.

Ørsted won the development right of the wind farm through bidding in 2017 and 2018, but there is almost no subsidy in the electricity price. The final investment decision of the project is expected to be made by the end of this year and to conduct grid connected power generation by the end of 2025. Half of the wind farm's capacity (450mW) has signed a long-term fixed price PPA contract to try to lock in the expected revenue.

It has been reported that Ørsted signed a power purchase agreement (PPA) with Covestro, a German high-tech material enterprise, which will purchase 100MW power of Borkum riffgrund 3 offshore wind farm at a fixed price. The agreement will be implemented from 2025 for 10 years, which was the largest corporate PPA in the history of offshore wind power industry at that time.

.jpg)

Last December, Amazon signed a 10-year enterprise power purchase agreement with Ørsted to purchase 250MW of an installed power generation capacity of Borkum riffgrund 3 offshore wind farm.

In order to ensure Glennmont's relatively fixed income as a fund investment, they also designed a 15-year power purchase and sale agreement to lock in the electricity price of most of the traded electricity through the fixed price and the upper and lower limit price, and only a small part of the electricity is traded through the market electricity price.

In fact, this is not the first cooperation between Ørsted and Glennmont. After an M & A transaction in 2019, both parties are investors in Germany's Gode I 330MW offshore wind farm, of which Ørsted holds 50% of the equity of the project and Glennmont holds 25%.

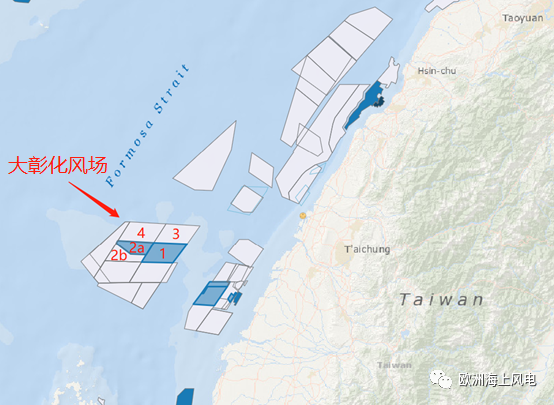

Selling half of the equity of wind farm development is a consistent routine of Ørsted. In April this year, Ørsted announced that it would sell 50% of the equity of 605MW Taiwan Da Changhua phase I offshore wind power project to Quebec savings and investment group (CDPQ) of Canada and Taiwan Cathay Pacific private equity fund for US $26.7 billion (about RMB 17.26 billion). Through this model, can maximize the return of cash, so as to develop new projects on a rolling basis.

.jpg)

Borkum riffgrund 3 wind farm is located in the North Sea of Germany. It is constructed in three phases with a total installed capacity of 900MW. The specific information is as follows:

Borkum riffgrund West 1 wind farm, with an installed capacity of 420MW, won the bid in April 2018, and the bid price was 46.6 euros / MWh;

Borkum riffgrund west 2 wind farm, with an installed capacity of 240MW, won the bid in April 2017, and the bid price is the market price, i.e. zero subsidy;

OWP west wind farm, with an installed capacity of 240MW, won the bid in April 2017. The bid price is the market price and zero subsidy.

Original: European offshore wind power

Author: ugil

Original link: https://mp.weixin.qq.com/s/zxwUryQccWGnT0N2CVmGwA